The Welfare State

Main policies

Old social policies

- Covering old social risks: Those related to health and the labor market.

- Pensions.

- Accident insurance.

- Health insurance.

- Unemployment insurance.

- Welfare state comes in when people cannot acquire necessary resources in the labor market; redistribution.

Social investment

We don’t provide insurance but equipment:

- New social risks: Welfare losses of individuals that derive from instability of family structures and the destandardisation of employment (Bonoli, G. (2007) ‘Time Matters. Postindustrialization, New Social Risks, and Welfare State Adaptation in Advanced Industrial Democracies’, Comparative Political Studies, 40 (5): 495-520.)

- Education.

- Requalification.

- Childcare.

- Welfare state comes in to enable people to acquire necessary resources in the labor market ; predistribution.

Why is the welfare state an institution

- Most components of the welfare state are social policies: health policy, childcare policy, pension policy and so on.

- Policies are typically conceptualised as outputs.

- However, these policies shape how individual or collective actors behave, just like the electoral system or the separation of powers.

- Example I: Individual’s decision whether to divorce may depend on how the welfare state protects single parents.

- Example II: Individual’s decision whether to move abroad may depend on transferability of pension entitlements.

An Institutional explanation

Welfare state regimes have effects on the widest possible range of outcomes:

- How many children are being born?

- At what age do people move out from their parents?

- At what age do people marry? Do they marry at all?

- How often do workers change their job?

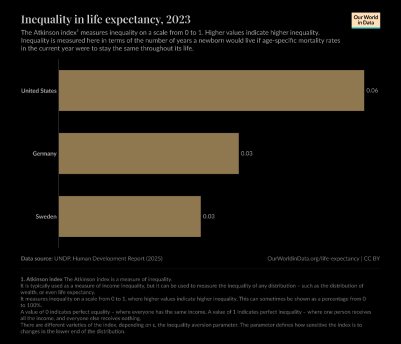

- How big is inequality in life expectancy?

- Do people rent or own the flat/house in which they live?

Political consequences

This has political consequences:

- E.g., homeowners vote more conservatively.

- E.g. pensions create their own political support coalition (feedback effects).

The Three Worlds of Welfare Capitalism

- Gösta Esping-Andersen (1990). The Three Worlds of Welfare Capitalism. Princeton: Princeton University Press.

- Question: how can we classify welfare states?

- Once again, a typology.

- Welfare regime: Interaction of market, state and family in managing social risks. (Van Kersbergen and Manow 2017: 365).

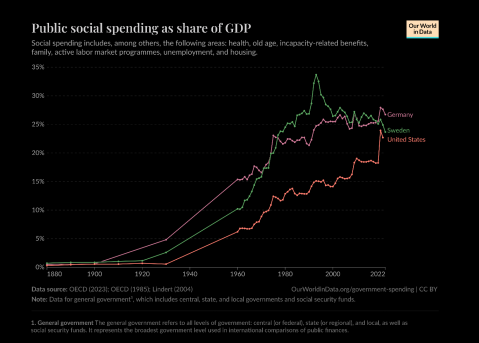

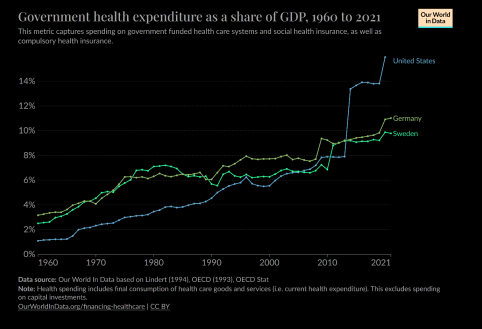

- Fundamental point: it is not about the size of spending per se!

- It’s not a matter of some states having big or small systems.

Not about spending per se

We can’t say that in CH there is hardly any public healthcare since insurance is mandatory and the state intervenes. Counting numbers is useless, you can’t just measure what they spend but how they do it.

We can’t say that in CH there is hardly any public healthcare since insurance is mandatory and the state intervenes. Counting numbers is useless, you can’t just measure what they spend but how they do it.

Two dimensions of the welfare state

- Decommodification: The degree to which social rights permit people to make their living standards independent of pure market forces. (Esping-Andersen 1990: 3)

- If people need to sell their labour on the market at all costs they are a commodity. Old people aren’t f.ex. as they don’t need to.

- Stratification: The welfare state is a stratification system in its own right. Does it enhance or diminish existing status or class differences? (Esping-Andersen 1990 : 4)

- To what extent the welfare state doesn’t consciously treat people differently based on richness.

Decommodification

How generous is the welfare state?

- Minimum level of benefits.

- Average level of benefits (e.g. replacement rates).

- Strength of entitlements (e.g. required length of contribution).

- Duration of benefits.

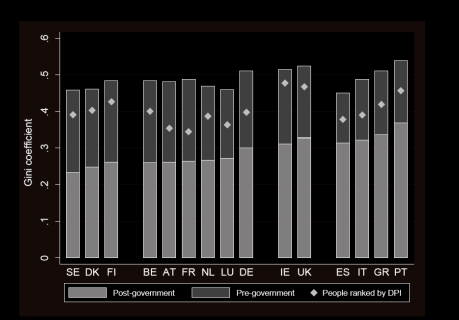

Stratification

To what extent does the welfare state treat different groups differently? Does it seek to preserve or to reduce status differences in society?

- Does everyone pay into the same pool or are there different insurances for different groups?

- How big is the gap between the minimum and the maximum benefit?

- Is the goal of the welfare state to prevent poverty or to preserve the individual’s standard of life?

- Rule of thumb: to what extent does it act like an insurance (with an insurance the more you insure the more you get in case of an accident)?

Pensions are stratifying f.ex., but so are German social insurances as different people have different pools according to their profession.

Examples

- In some countries, public servants have their own pension system that is separate from the standard pension system.

- Possibility to opt out of public health insurance.

- Are beneficiaries allowed to keep their wealth (e.g. homeownership) or do they need to sell it?

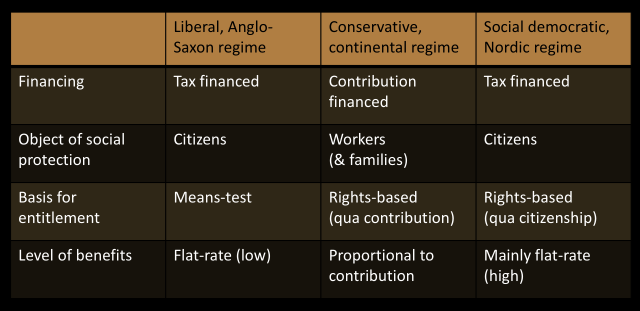

The three regimes

- Liberal: USA, UK, Canada, New Zealand, Australia, Ireland.

- Conservative: Germany, Austria, Belgium, the Netherlands, France.

- Social-Democratic: Sweden, Denmark, Norway, Finland.

- Unclear: Switzerland (kind of a mix between conservative and liberal…)? Mediterranean Countries?

ç

ç

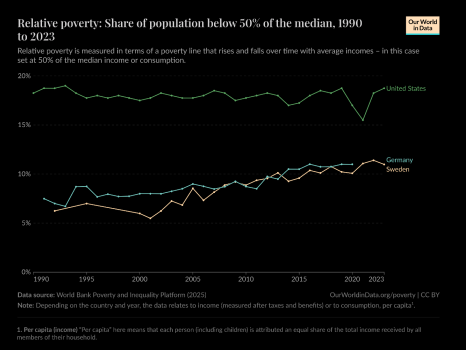

Basically correlation between inequality and type of regime.

Basically correlation between inequality and type of regime.

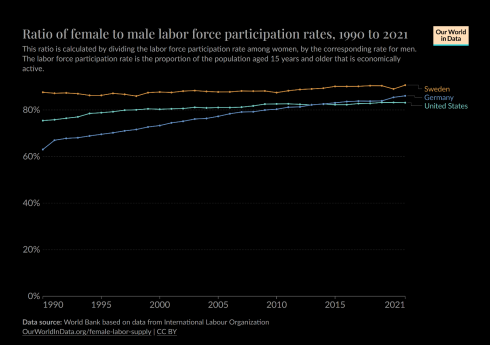

Conservative models incentivise households with one breadwinner.

Conservative models incentivise households with one breadwinner.

As with all typologies, these are ideal types. They capture a general tendency, but individual countries often deviate in specific policy fields. Example: the British National Health Service (NHS).

Do the outcomes fit the model?

- Esping-Andersen offers a very macro-perspective.

- He looks at the structure and internal logic of various policies.

- How does this look like from the micro-perspective?

- How does the welfare state affect individuals’ lives?

A focus on decommodification

- Our definition of the welfare state follows Esping-Andersen’s concept of decommodification and summarizes the entity of social policies and institutions that guarantee a person the maintenance of a ‘livelihood without reliance on the market’ (Esping- Andersen, 1990: 22). Our research interest is limited to the economic dimension and includes policies that affect the distribution and redistribution of income – essentially, wage policies, taxation, transfer payments and pension systems.

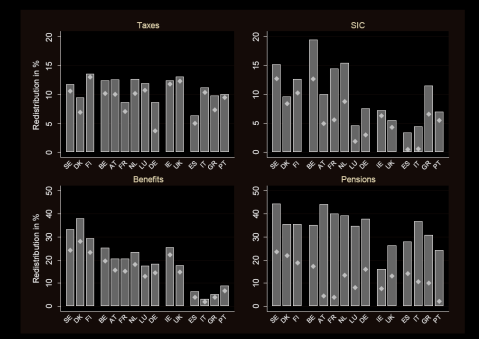

Regimes and inequality reduction

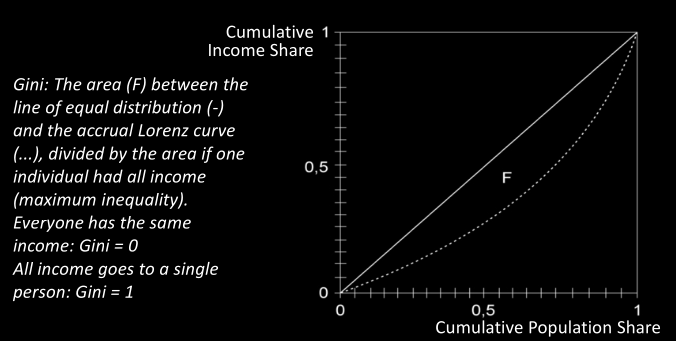

Understanding the concepts

- What is the conceptual difference between pre-government and post-government inequality?

- What is the Gini coefficient?

Gini Coefficient

Which outputs (policies) generate the outcomes

Rule of thumb: Inequality is reduced by spending

- Scandinavian welfare states achieve the biggest reductions in inequality.

- However, they do not do this by taxing the rich so much.

- Rather, taxes are high for everyone (very high Value-Added-Tax).

- Instead, the major part of inequality reduction occurs on the spending side.

- It’s more about how and how much you spend that how much and who you take from.

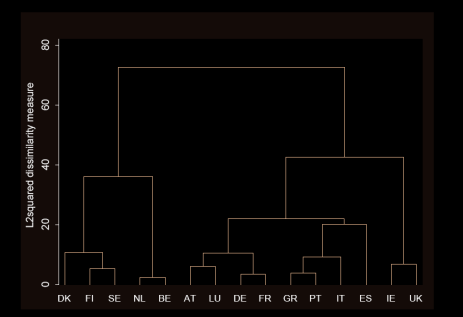

Does the data support the model?

For the most part, yes. Similarities are almost 100% aligned with the model.

For the most part, yes. Similarities are almost 100% aligned with the model.

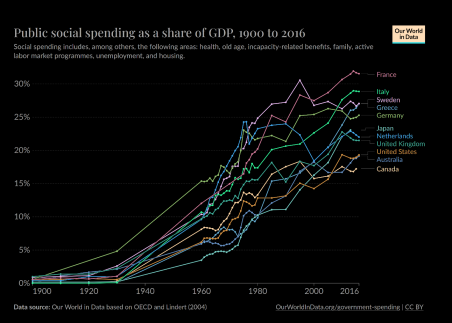

How did the welfare state come about

- A functionalist explanation (cf. session 1): industrialisation and demographic change generate social problems (dominance of wage labor → unemployment risk, old age risk) to which all countries react with welfare programs.

- A strong version of the functionalist would predict convergence: the same problems should lead to the same solution.

- Esping-Andersen (and many others) point to enduring and important differences: while all countries develop a welfare state, it is structured very differently.

The functionalist explanation

The more people work in service and industry, and less in agriculture+the more old they are=the more of GDP gets spend on public social spending.

The more people work in service and industry, and less in agriculture+the more old they are=the more of GDP gets spend on public social spending.

- Esping-Andersen’s names for the three types contain his theory of welfare state emergence: The strength of different political movements determines the shape of the welfare state.

- Most important actor: Social Democrats, the labor movement.

- The strength of Social Democracy and the need for compromises determines the welfare regime.

- The Christian-Democratic regime reflects the need for compromise between Social Democrats and Christian Democrats.

- In Scandinavian countries Social Democrats were more dominant f.ex.

A revisionist view: Varieties of Capitalism

Esping-Andersen: „Decommodification strengthens the worker and weakens the absolute authority of the employer. It is for exactly this reason that employers have always opposed de-commodification“ (1990: 22) But: important role of Christian-Democratic parties in continental Europe. But: The first one to introduce social insurance was Bismarck in Germany (Health insurance 1883, Accident insurance 1884)

Take social insurance seriously

- Employers may actually like the insurance-dimension of the welfare state.

- Insurance logic means: Covering of potential risks enables people to take these risks in the first place (Estevez-Abe/Iversen/Soskice. 2001: Social Protection and the Formation of Skills: A Reinterpretation of the Welfare State. In: Hall/Soskice: Varieties of Capitalism).

- Important risk in the labor market: specialization (specializing in one occupation, one firm, one product…).

- Firms want that their employees to specialize!

- Welfare state potentially efficiency increasing.

Rehabilitating stratification

- Stratification emphasizes the insurance-dimension of the welfare state: protecting living standards rather than preventing poverty. In this view, stratification can be seen as an instrument to encourage specialization.

- E.g.: If you are allowed to keep your house when unemployed, you are more willing to take a job with a higher risk of unemployment. → Stratification allows a stronger focus on long-term gains of cooperation.